Financial literacy is an essential life skill that helps individuals make informed financial decisions. It is the knowledge and skills needed to manage personal finances effectively. Unfortunately, many young people are not taught financial literacy, which can lead to financial struggles in adulthood. In this blog, we will discuss the importance of financial literacy, provide tips for teaching it, and discuss strategies for overcoming obstacles.

Importance of Financial Literacy

According to the Boarding Schools in India, Financial literacy is essential for financial success. Individuals who are financially literate are better equipped to manage their finances, create budgets, make informed investment decisions, and avoid debt. It also helps individuals understand their consumer rights and responsibilities and make informed decisions about purchases.

Financial Literacy Concepts

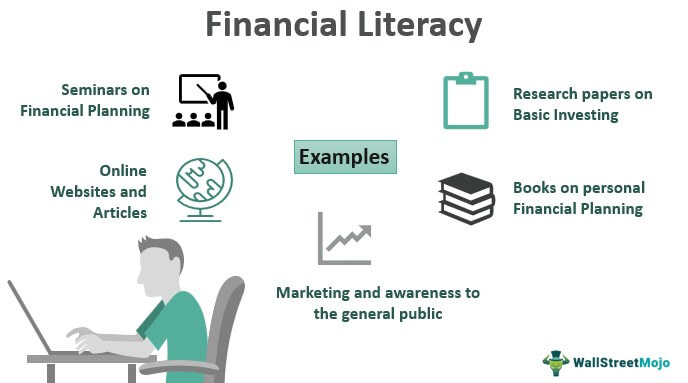

To teach financial literacy effectively, it is essential to cover key its concepts. These include:

- Understanding Financial Terms

- Budgeting

- Money Management

- Understanding Credit and Debt

- Saving and Investing

- Consumer Rights and Responsibilities

Each of these concepts is crucial for individuals to understand to make informed financial decisions.

Tips for Teaching Financial Literacy

As per research conducted by Schools in India, Teaching financial literacy can be challenging, but some tips can make it more effective. Starting early, using real-life examples, making it interactive, incorporating technology, and partnering with financial institutions are all strategies that can help make it more engaging and meaningful.

Obstacles to Teaching Financial Literacy

Several obstacles can make it challenging to teach financial literacy. These include:

- A lack of Resources

- A lack of time in the Curriculum

- Teacher Training and Confidence

- Parental Involvement

- Misconceptions about Financial Literacy

Strategies for Overcoming Obstacles

To overcome obstacles to teaching financial literacy, several strategies can be employed. Seeking outside resources, integrating financial literacy across the curriculum, providing teacher training, engaging parents, and correcting misconceptions are all strategies that can help ensure that it is effectively taught.

Conclusion

In conclusion, financial literacy is an essential life skill that is often overlooked in education. Teaching its concepts is critical for financial success and helping individuals make informed financial decisions. Starting early, using real-life examples, making it interactive, incorporating technology, and partnering with financial institutions are all tips that can help make teaching financial literacy more effective.

To overcome obstacles to teaching it, seeking outside resources, integrating financial literacy across the curriculum, providing teacher training, engaging parents, and correcting misconceptions are all strategies that can help ensure that it is effectively taught. By teaching it effectively, we can help individuals make informed financial decisions and set themselves up for financial success in the future.

For any queries related to parenting, schooling, or any student-related tips, click here to check out our latest blogs.